About The event

AI is revolutionizing the financial sector throughout Europe, allowing banks to provide more tailored, efficient, and safe services. In a locale characterized by varied regulatory frameworks and swiftly changing consumer expectations, AI solutions are enabling Financial Services to streamline operations, mitigate fraud, and improve client experiences. European banks & insurers are utilizing AI, including AI-driven chatbots and robo-advisors for round-the-clock help, as well as sophisticated machine learning algorithms for market trend prediction and real-time anomaly detection, to maintain competitiveness. With the rapid advancement of digital transformation, AI-driven banking & insurance is emerging as the foundation of innovation within the European financial sector, providing a future of more intelligent and adaptable financial services.

The Digital Banking & Insurance Experience Summit is a two-day event that will explore the ways in which AI is improving consumer experiences, improving operational efficiency, and reshaping digital banking strategies. Through expert-led sessions, panel discussions, and networking opportunities, attendees will acquire a deeper understanding of the most recent AI-driven innovations and best practices in finance.

Whether you want to stay ahead of the AI curve or find ways to improve financial services, this conference is the perfect place to explore the future of AI-powered banking. Join us in London to engage with industry leaders and learn about the ways in which AI is transforming the banking sector.

Dive into the interactive world of Digital banking

Discover the Next Era of AI-Powered Insurance

Key discussions

Generative AI powered by deep learning:

The McKinsey Global Institute (MGI) estimates that Generative AI could contribute between $200 billion and $340 billion annually to the global banking sector, or 2.8% to 4.7% of total industry revenues, primarily through enhanced efficiency. This underscores GenAI's capacity to revolutionize financial organizations by optimizing operations, improving decision-making, and minimizing expenses. GenAI automates functions including risk assessment, customer service, and compliance, while producing predicted insights and tailored interactions. To maximize its advantages, banks must establish strong data governance and seamless integration, allowing them to provide more intelligent, rapid, and tailored services.

Enhanced fraud detection:

Advancements in AI, machine learning, and deepfakes are expected to significantly contribute to the anticipated increase in fraud risks, as 70% of financial professionals predict. In order to combat fraud, financial institutions are prioritizing technology investments, with over two-thirds of them prioritizing AI fraud detection. In order to identify suspicious activities by perceiving patterns and anomalies, AI fraud detection employs machine learning models to filter through extensive datasets. These algorithms become increasingly adept at anticipating and preventing fraudulent user behavior as they continue to acquire new data. Advantages of AI fraud detection include cost-effectiveness, improved predictions with larger datasets, reduced manual review time, and quicker, more efficient solutions.

Personalized Customer Experience:

Artificial intelligence (AI) can be used by banks to provide personalized customer experiences. AI can analyze a customer's financial history, spending patterns, and investment behavior to offer tailored financial advice. It can also predict customer needs based on past transactions and interactions, allowing banks to offer proactive solutions. AI-powered chatbots and virtual assistants can provide 24/7 assistance, offer dynamic product recommendations, and detect and prevent fraud. AI can also create customized marketing campaigns, assess creditworthiness using non-traditional data, and enhance interactions through emotional sensing. Hyper-personalized user interfaces can be provided by AI, highlighting relevant services or frequently used features. AI-powered tools can automate financial management, helping customers automate their savings, investments, and budgeting. These AI-driven strategies can strengthen customer relationships and enhance satisfaction and loyalty.

Why attend?

Who should attend?

CXO’s, VPs, Directors, Heads, and Managers:

- Technology

- Innovation

- Digital

- Data

- Operations

- Information

- Fraud & Risk

- AI/ML

- Data Science

- Automation

- Strategy

- Digital Transformation

- Digital Banking

- Open Banking

- Customer Experience

- Customer Insights

- Customer Engagement

- IT

- Cloud Architect

- Compliance

- Cybersecurity

- Ethics & Governance

- Product Owner/Manager/Director

Topics to be covered

- Open Banking

- InsurTech

- Sustainable Finance

- Digital Finance

- Customer Experience

AI-Powered Financial Services

Machine Learning in Banking & Insurance

Data Analytics & Customer Insight

AI for Fraud Detection

Personalization in Financial Services

Customer Journey Optimization

AI-Driven Chatbots & Virtual Assistants

Embedded Finance & InsurTech

Underwriting Transformation

Intelligent Claims Processing

Speakers

Ange Johnson De Wet

Sean Musch

Mari Parry

Zahraa Murtaza

Pallavi P Kapale

Konstantina Kapetanidi

Eric Alter

Arun Narayanan

Mark Lewis

Reuel Palany

Oksan Orhan

Joanne Biggadike

Milad Armani Dehghani

Edmund Towers

Janet Xinyi Guo

Dr. Nathalie Moreno

Ray-Allen Taylor

Oleksandr Honchar

Martin Wallraff

John Somerset-Irving

Aarsh Srivastava

Sumit Kumar

Christoph Esslinger

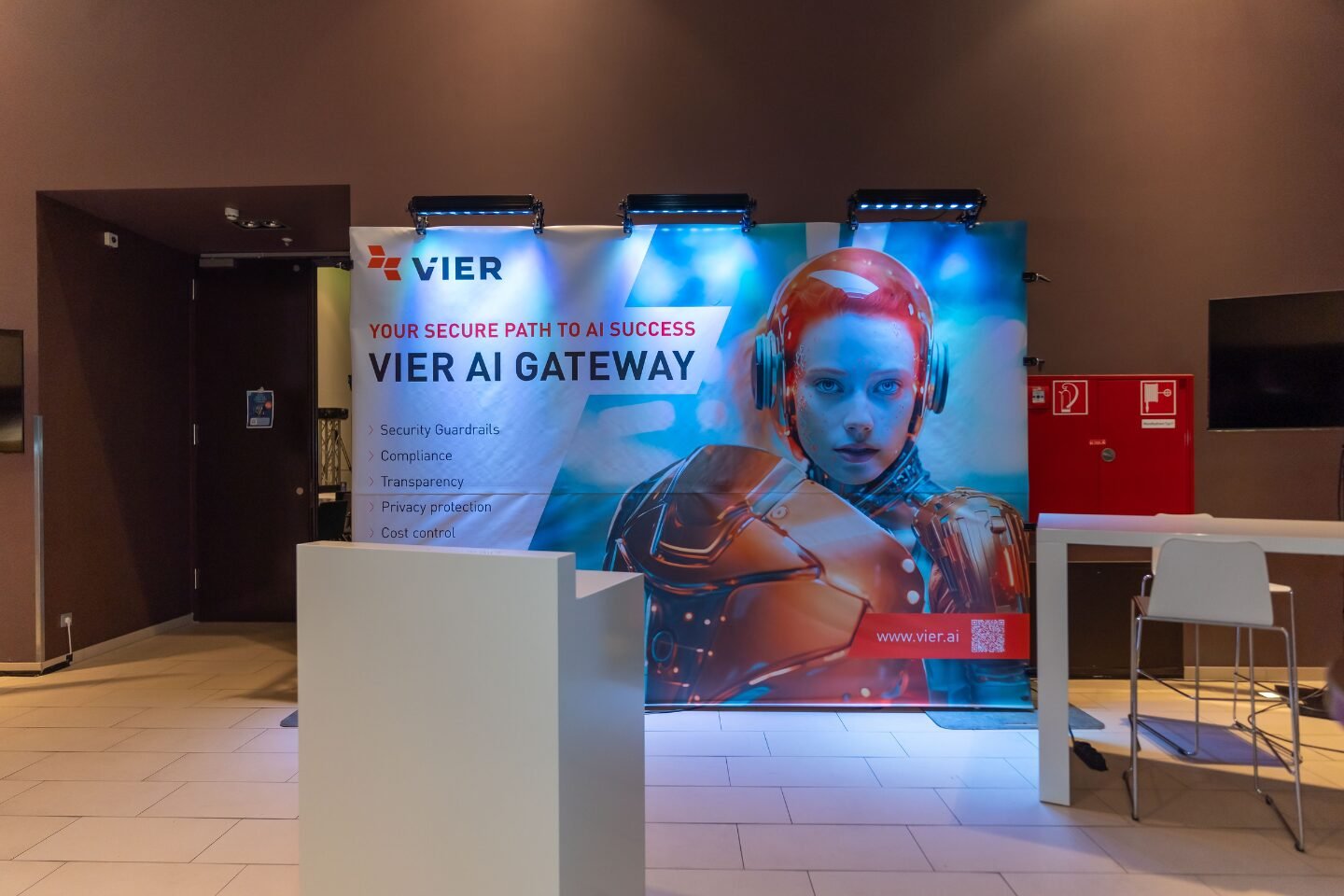

Sponsors

Partners

Media Partners

Get to the venue

Airport

London City Airport – 3.1 miles

TRAIN

Docklands Light Railway – 1.0 mile

Metro

Canary Wharf, Underground Ltd – 0.8 mile

Hotel

Radisson Blu Hotel, London Canary Wharf East

5 Fairmont Ave, London E14 9JB, United Kingdom

Gallery